44+ mortgage interest deduction rental property

Web The property tax deduction. Ad Over 300000 Borrowers Private Money Lenders Matched To Date.

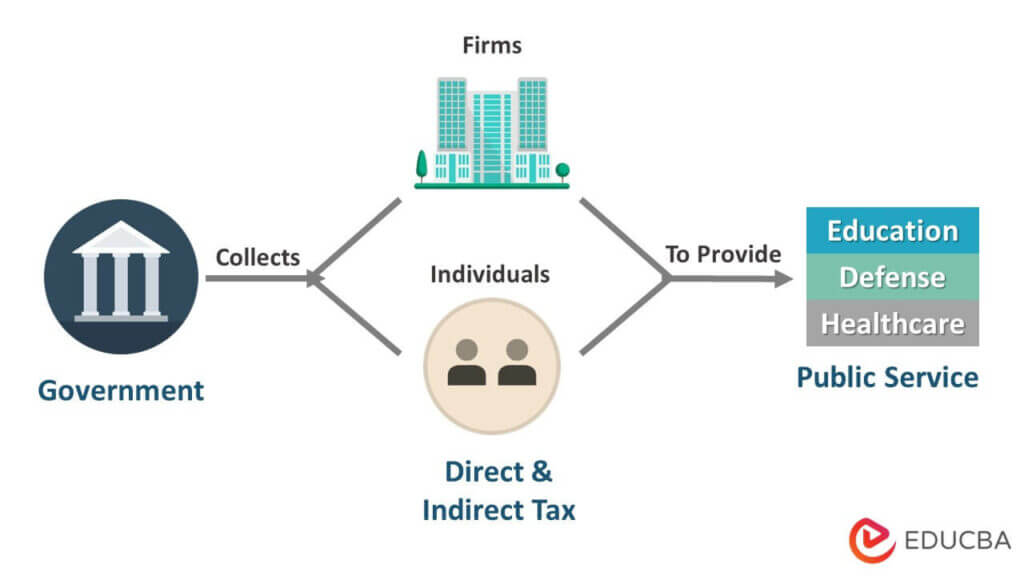

Taxation Definition Real Examples Principles Types

Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year.

. If you own more than one property the. Take Advantage And Lock In A Great Rate. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional.

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. See your rate online now. Salary before tax 25000 Property income calculation.

This annual allowance accounts for a propertys wear. Try It For Free. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

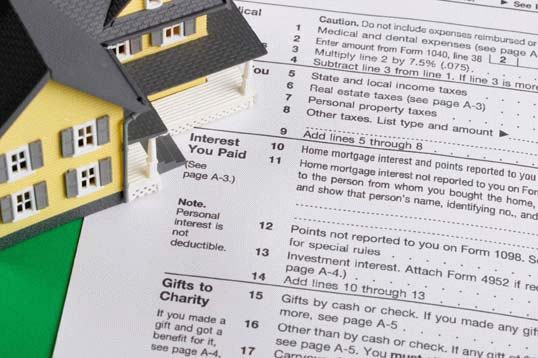

You can also depreciated 67. Use NerdWallet Reviews To Research Lenders. Web On your 1098 tax form is the following information.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Ad Even lower rates with 51 71 ARM on rental property loans. Rental income 11000 Finance costs 8000 x 75 -.

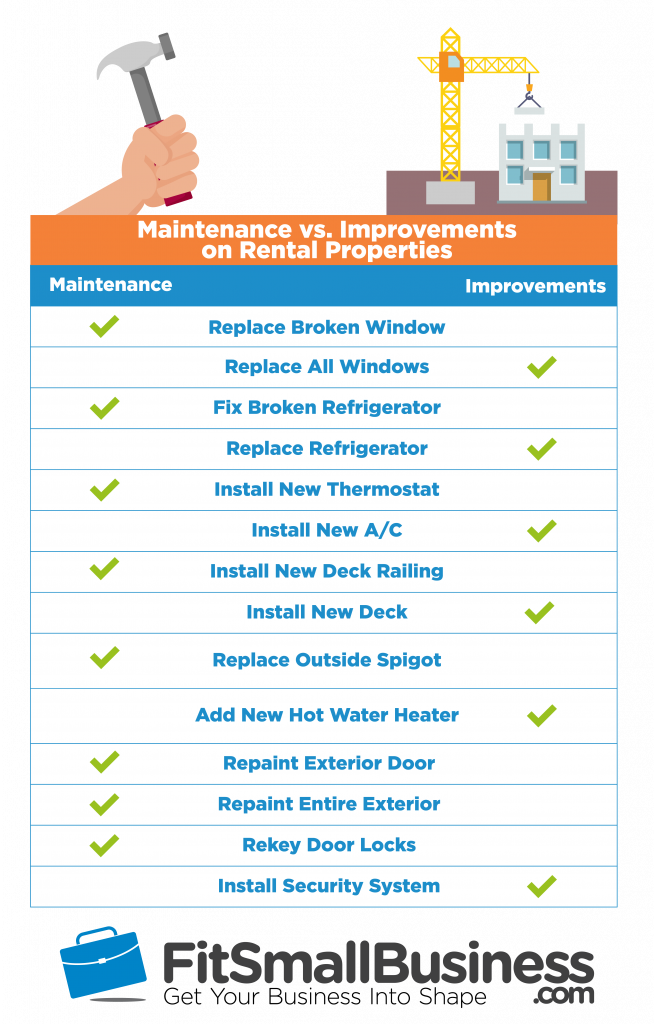

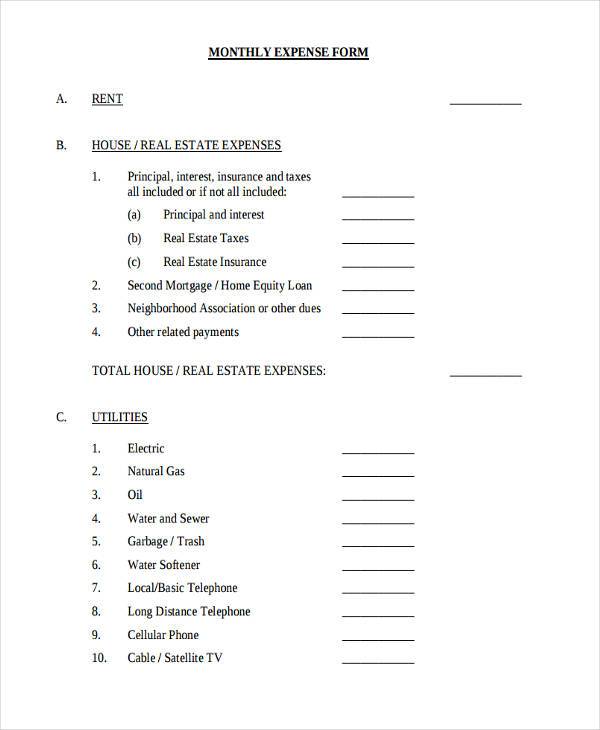

Web Borrower-paid mortgage insurance premiums are tax-deductible as an itemized deduction. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web These expenses relate to a number of business-related activities that include buying operating and maintaining the property that all add up to make it a thriving rental.

Households with adjusted gross incomes AIG of 100000 or less will be. For many owners mortgagee interest is their largest. Web Include advance rent in your rental income in the year you receive it regardless of the period covered or the method of accounting you use.

Investment Rental Property Financing For Real Estate Investors. Web Lets assume that the interest paid on the mortgage would amount to approximately 16000 in the first year of the loan. Web Mortgage Interest On Rental Property - If you are looking for options for lower your payments then we can provide you with solutions.

Received 40000 from rental. Web Mortgage Broker Loan Processing The Complete Guide 2023 Ad Access Tax Forms. Box 1 Interest paid not including points.

Try For Free Today. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. Web Mortgage interest.

Homeowners who bought houses before December 16. Rental property mortgage interest. Box 3 Mortgage origination date.

But for loans taken out from. Web When you filed your taxes as a single person you were able to deduct mortgage interest on your main home and a second home. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Investment Rental Property Financing For Real Estate Investors. Should that owner have a rental. Ad Over 300000 Borrowers Private Money Lenders Matched To Date.

Sponsored Mortgage Options for Fawn Creek Township. Box 2 Outstanding mortgage principle. Web Taxpayers must recover the cost of rental property through an income tax deduction called depreciation.

Web Her mortgage interest is 8000 per year. Web Median Rent. Web If 67 of your personal residence is rented then you can deduct 67 of the mortgage interest property taxes utilities internet etc.

Try For Free Today. Web The property taxes are also deductible. During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Learn More About Mortgage Preapproval. As a married couple filing.

Browse Information at NerdWallet. However higher limitations 1 million 500000 if married. Try It For Free.

Web The most common tax deduction most homeowners and rental property owners use is mortgage interest. 51 71 ARM with interest-only cash out options stronger cash flow. Unlike the home mortgage deduction all rental property expenses are itemized on Schedule E.

![]()

How Rental Income Is Taxed Property Owner S Guide For 2022

Vacation Home Rentals And The Tcja Journal Of Accountancy

Business Succession Planning And Exit Strategies For The Closely Held

Loan Vs Mortgage Top 7 Best Differences With Infographics

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Is Your Mortgage Considered An Expense For Rental Property

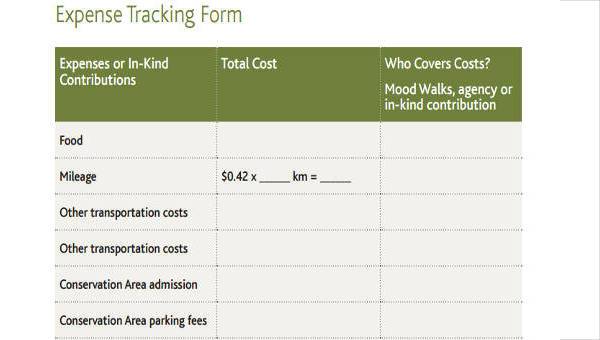

Free 44 Expense Forms In Pdf Ms Word Excel

Vacation Home Taxes Second Home Buying Tips And Articles

Is Interest Paid On Investment Property Tax Deductible

Free 44 Expense Forms In Pdf Ms Word Excel

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Pdf The Influence Of Capital Requirement Of Basel Iii Adoption On Banks Operating Efficiency Evidence From U S Banks

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Mortgage Interest Deduction How It Calculate Tax Savings

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

44 Agreement Form Samples Word Pdf